Digitaal handelen is een enorme kans voor jou als Belgische ondernemer. Als e-business federatie willen wij Belgische webwinkels (onze leden) en online spelers helpen om first in class te worden, elk in zijn speelveld(en), of dat nu B2B, B2C of D2C is.

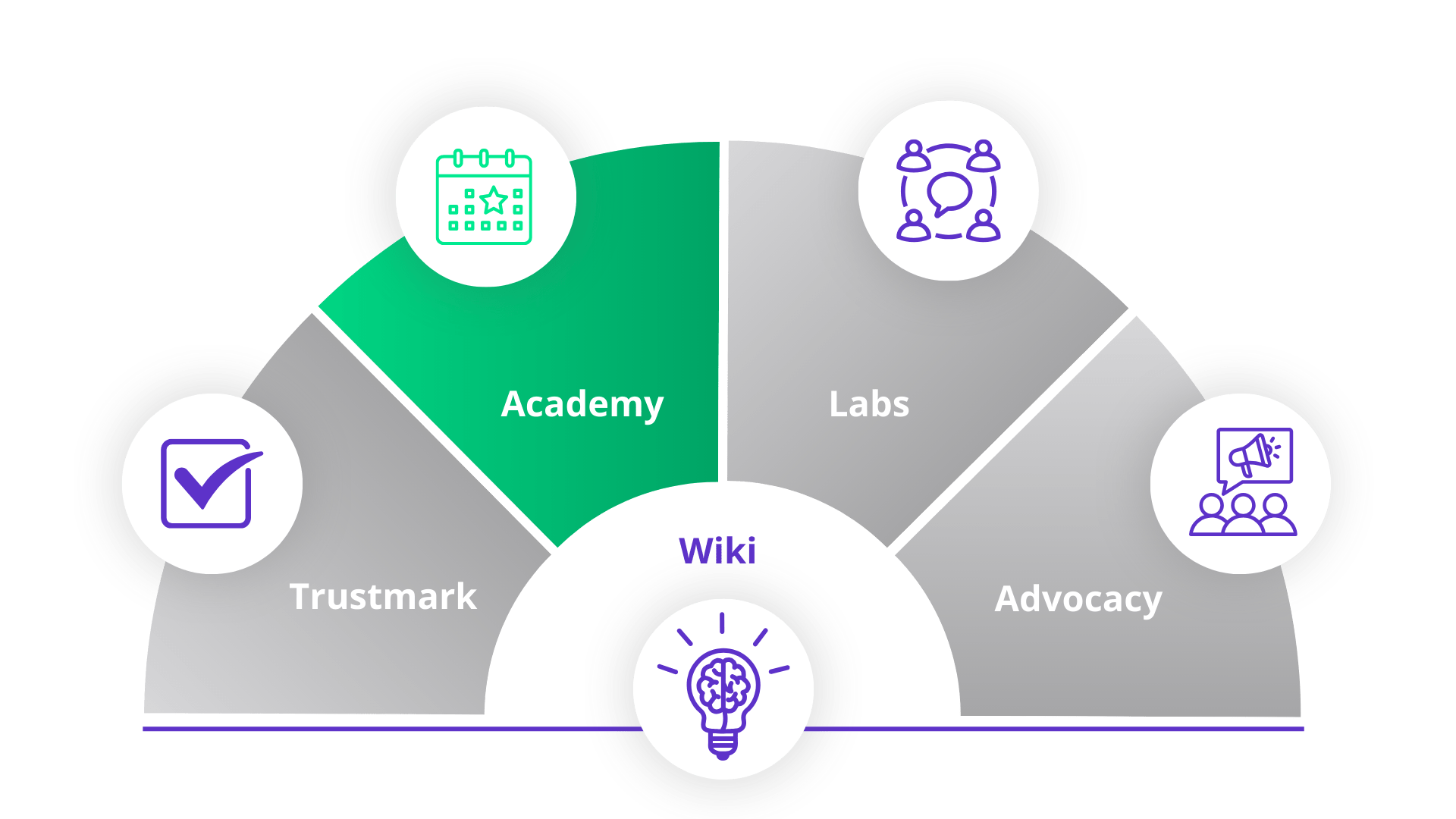

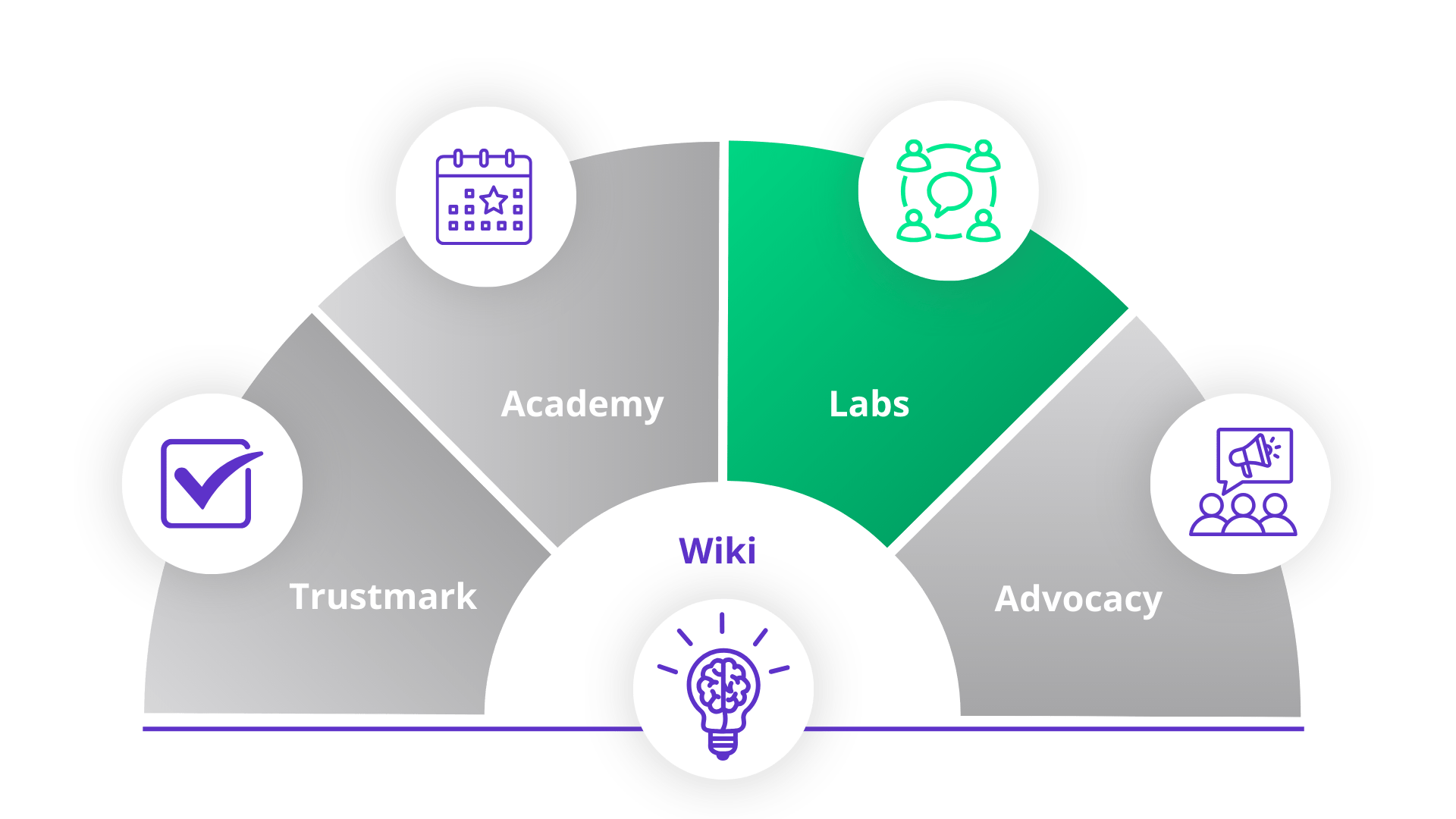

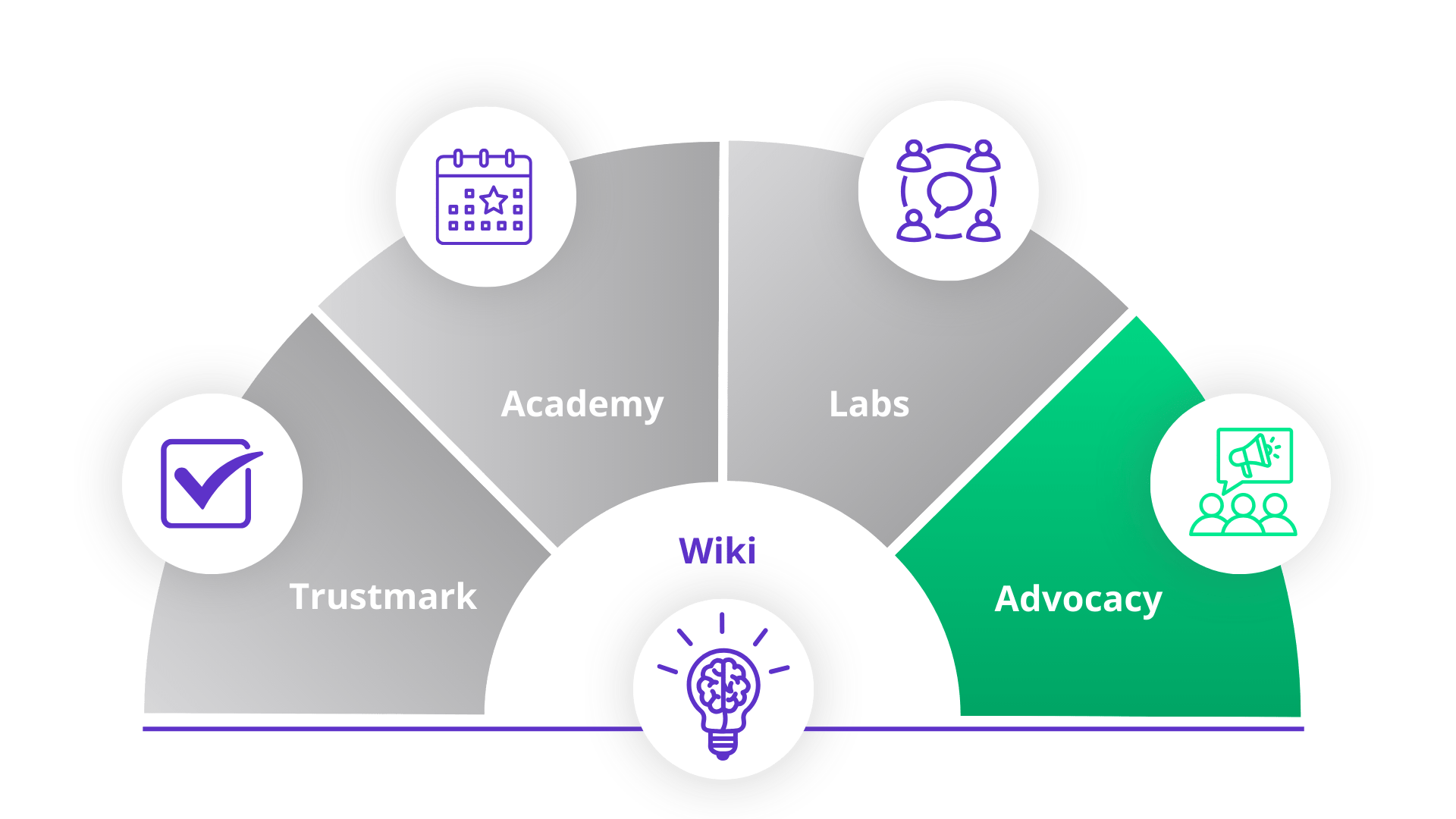

Hoe kunnen we jou helpen groeien?

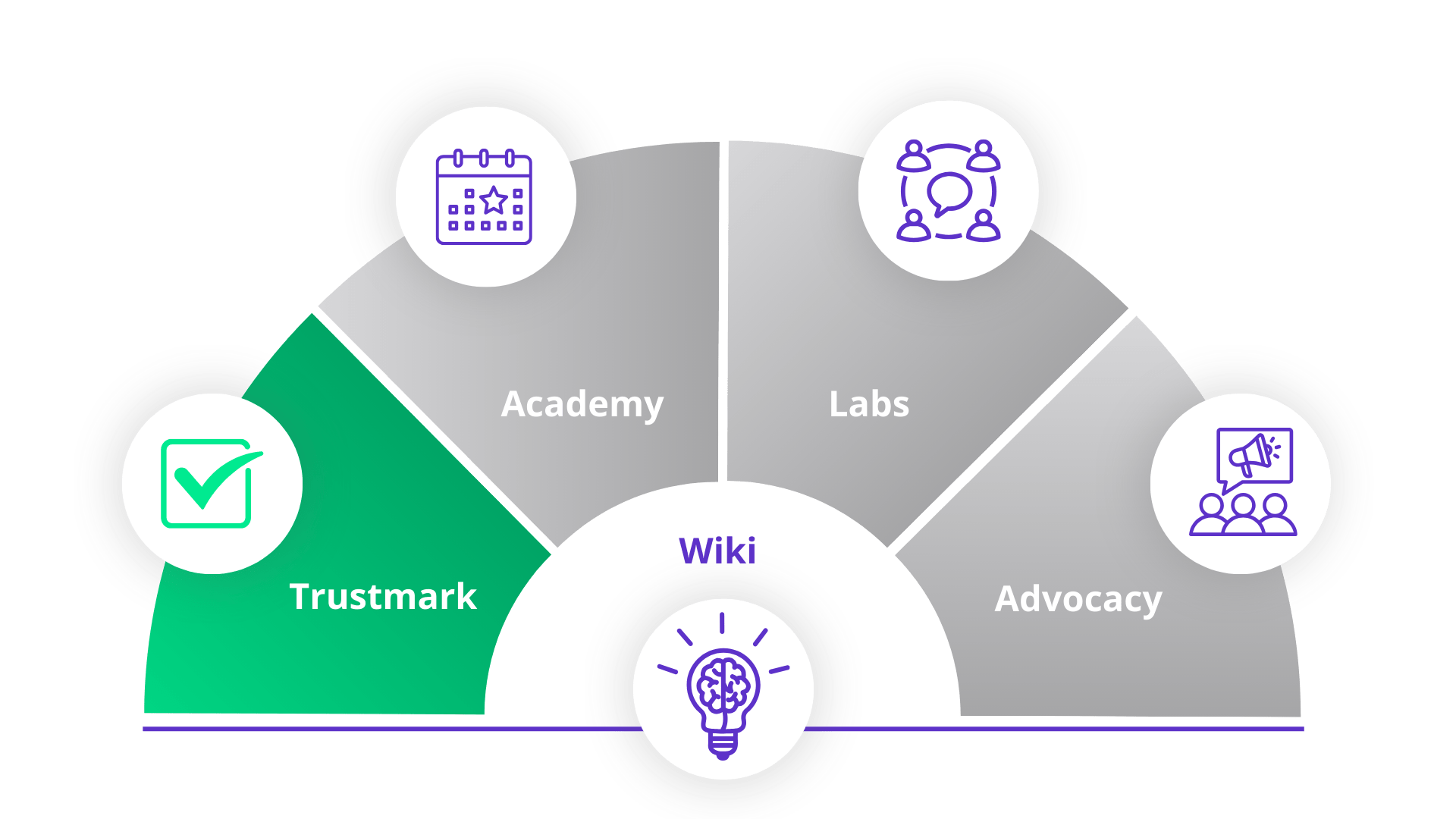

Trustmark

Becom an example. Toon aan de consument dat jij een betrouwbare webshop bent aan de hand van het Becom Trustmark met een heus vertrouwensprofiel en badges.

Academy

Becom a wizard. Neem deel aan onze events en opleidingen, online of offline. In deze snel evoluerende digitale wereld is kennis immers de sleutel tot succes.

Labs

Becom an expert. Hier bespreken we de voornaamste bekommernissen in de markt, doe je heel wat inzichten op en werk je met gelijkgezinde vogels standpunten uit.

Advocacy

Becom an authority. We zorgen dat je alle wetgeving op de voet kan volgen en dat je standpunten gehoord worden bij de overheden op lokaal, nationaal en internationaal niveau.

Wiki

Het kloppend hart van onze federatie. Noem het de bibliotheek, het kenniscentrum, het archief én de encyclopedie… want je vindt hier alle content en expertise over en rond digitaal handelen en e-commerce: white papers, checklists, standaarddocumenten, opnames van webinars, podcasts, blogartikels, presentaties, …

Kortom, alle gedeelde kennis en ervaring door experts, leden en partners zit hier voor jou gebundeld. Struin er rustig eens door of zoek gericht op thema, format of beide.

Ontdek wiki

26.10.2023 | Becom Awards

Becom, de nieuwe E-Business federatie, reikt voor het eerst de Becom Awards uit

Smartphoto, Mamzel en Dag & Nacht winnen de Becom Diamond Award 2023

Zien we jou op één van onze volgende activiteiten?

Friday Snacks

Je leerrijke pauze op vrijdagnamiddag.

Tijdens deze gratis webinars van slechts een half uurtje laten we een expert aan het woord over één bepaald topic.

Neem er lekker een kop koffie of thee bij en geniet van deze Friday Snacks om de werkweek af te sluiten.

Ontdek de volgende Friday Snacks in onze Becom Agenda.

Schrijf je nu in

The Days: Eco Wednesday

Voor webshops met een groen hart.

Heb je ecologische producten, werk je met duurzame verpakkingen of worden je producten “bewust bezorgd”? Dan zetten we graag jouw webshop in de kijker op Eco Wednesday. Die gaat dit jaar door op woensdag 15 mei 2024.

Schrijf je nu in

Bootcamp: BeCyberSafe

Versterk je cyberveiligheid.

Ben je wel goed beschermd tegen pakweg hackers, phishing, lekken van persoonsgegevens of zelfs financiële gegevens van je klanten? Zitten de koppelingen met derde partijen zoals marktplaatsen, social selling platformen of AI-oplossingen met chatbots wel goed? Krijg inzicht in de terminologie, problematieken, gevoeligheden én oplossingen van cyber security voor e-commerce. In mensentaal.

Meer info & inschrijvingZij behaalden onlangs het Becom Trustmark

Proficiat aan onze nieuwe leden!